Although the bitcoin price has been rising it has failed to surpass the $70,000 level in the past weeks. In fact, it reached a monthly high of $69,462 on 21 October and a low of $58,895 on the 10th. At the time of writing, it is trading at $67,043 BTC/USDT on Gate.io exchange. However, the asset is currently moving sideways. The following graph shows the bitcoin 7-day price chart.

Reasons for Bitcoin’s Price Stagnation and its Failure to Break Above $70k

As said above, bitcoin has failed to break above $70,000 during October. Several reasons might have contributed to that. However, the possible reasons include global economic uncertainty, bitcoin miner selling pressure and low network activity.

Global Economic Uncertainty: Despite the recent Federal rates cut and the adoption of some expansionary monetary policies in several countries including China, investors confidence remains very low. Bitcoin, ranked among the top investment assets that include TSMC, Berkshire Hathaway, Tesla, and Walmart stocks, has attracted low capital inflow since mid-October. However, the leading traditional assets have been having steady returns of around 4.7%. Thus, with the current bitcoin trend traditional investors are unwilling to shift their capital to the number one cryptocurrency. They are likely to invest in it once its price flips past the $70,000 level.

Uncertain Political Future and Geo-political Tensions: The geo-political tension in the Middle-East may be contributing to the current bitcoin performance. Normally, during periods of political instability in certain geographical regions many investors are not willing to invest in risky assets such as bitcoin. In addition, to the Middle East political crisis the uncertainty around the presidential results of the United States has dampened the investors confidence. The crypto community believes that Kamala Harris’ win may lead to stiff crypto regulations in the country. On the other hand, Donald Trump’s victory may spell a bright future for cryptocurrencies.

Bitcoin Miner Sell Pressure And Onchain Activity

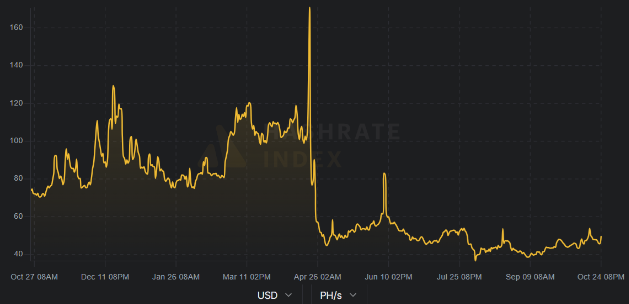

At the present time, bitcoin mining is under strong headwinds. For example, the hashrate has fallen to $49 per petahash per second (PH/s) daily. This represents a 50% drop since April when bitcoin halving occurred. This has financially constrained the miners who are important players in the sector. As a result, they have resorted to selling their past BTC holdings to cover for operational expenses. Thus, this trend has unsettled the traders who predict that the miners may increase their selling pressure.

As seen on the graph, the bitcoin mining hashrate has been falling since April. Usually,such a situation forces the miners to operate under losses. There are other shocking statistics pertaining to bitcoin. For example, Bitcoin’s 7-day average active addresses has remained flat over since April. This is another indication that the bitcoin market is depressed.

High Inflation Rate: The high inflation rate in the United States and other leading economies is also contributing to the low performing cryptocurrency market. The high inflation results in a strong United States dollar which reduces the appeal of digital currencies including bitcoin. During such a period investors put their money in assets which have constant returns on investment such as stocks.

Bitcoin Price Performance and Prediction

During the previous week the bitcoin price constantly rose and closed near previous highs. The rising institutional demand for bitcoin ETFs has helped to generate a positive market sentiment for the asset. Even during the last few days there was an increase in funds flow into the ETFs. So far, during October the bitcoin ETF sector in the United States recorded approximately $3 billion in net inflows.

Bitcoin’s price is currently targeting $70,000. A break above that level may push its price towards $72,000. Reaching that mark would provide psychological support to the investors. At the moment there are several technical indicators that point to a bitcoin bullish move within the coming days. For instance, the bitcoin price is still above the 50-day EMA and the 100-day EMA. The next graph summarizes the current bitcoin price trend.

As the above diagram indicates, the Ichimoku cloud is green and is gently rising which indicates a bullish momentum. Nevertheless, there is a bearish bias that is rising from the formation of a double top candlestick pattern. If that pattern formation completes it will indicate a possibility of a bitcoin price fall within the next coming few days. The other bearish cue is the falling ADX line. At this point, the ADX indicator has a reading of 18, which is a strong bearish signal. Thus, that indication may force many traders to exit their long positions. Generally, traders close long positions when the ADX reading flips below 20.

If the selling pressure rises the bitcoin price may drop to $60,000. The other key support levels are at $57, 714 and $53,900. On the other hand, a rise in buying momentum may drive its price towards $69,255. The other closest critical resistance levels are located at $69,200 and $71,597.

More Stories

JForex Platform: Complete Setup and Trading Guide

Cryptocurrency in Modern Betting

How to Successfully Launch Your Token in a Crowded Market